Welcome to IL’s Ultimate Event 2012 Conference “Live Well for Less in the World’s Best-Value Destinations”

Introduction to Our Sponsors, Speakers and Exhibitors. (This presentation has no accompanying PowerPoint slideshow.)

Introduction to Our Sponsors, Speakers and Exhibitors. (This presentation has no accompanying PowerPoint slideshow.)

International Living’s longtime editors explain how and why they made the decision to uproot their comfortable lives and embrace a world of adventure and uncertainty as expats. What went through their minds and how did they prepare for the big move? Listen in to find out more... (This presentation has no accompanying PowerPoint slideshow.)

There’s no time like the present to put the wheels in motion and make your dream life overseas a reality. But where to start? Dan Prescher shares his strategies, tips, and suggestions, gleaned from over a decade of experience.

Is it crazy to consider living in another country? John shares the story of how the “crazy” decisions he and his partner Sue made have culminated in a healthier, happier, and ultimately more rewarding life in Ecuador.

Ronan drills in on his three favourite strategies to follow if you want to profit from International Real Estate. Specifically he shows you how you can profit from the Path of Progress, A new middle class and even places where the Real Estate market is deeply distressed.

Margaret explains how Pathfinder scouts the world to find the hottest real estate deals – and how you can do it too.

Don’t let U.S. tax and reporting requirements spoil your expat experience. Every American expat needs to clearly understand the financial and tax issues that result from living and working abroad. In this session, Nick Hodges, CPA/PFS, MBA, CFP, will give you the information you need to maximize your U.S. tax opportunities and avoid potential IRS minefields so you can make your expat experience a financially carefree one.

It is important for Canadian residents who are purchasing real estate abroad to consider not only the laws of the country where the real estate will be acquired but also the laws of Canada, particularly tax laws. The tax implications for Canadians will vary depending upon factors such as whether or not the real estate is located in a country with which Canada has a tax treaty and whether or not the property is being used for personal use only, for purposes of generating rental income or for a combination of the two.

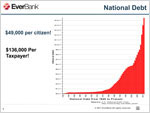

An in-depth look at the benefits of diversifying outside of the US dollar into foreign currencies and metals, and why the current debt situation in the United States makes it more important now than ever.

Why it id essential that you act to protect yourself, your family and your wealth now.